Home Buying Tips from Jan Lazzara

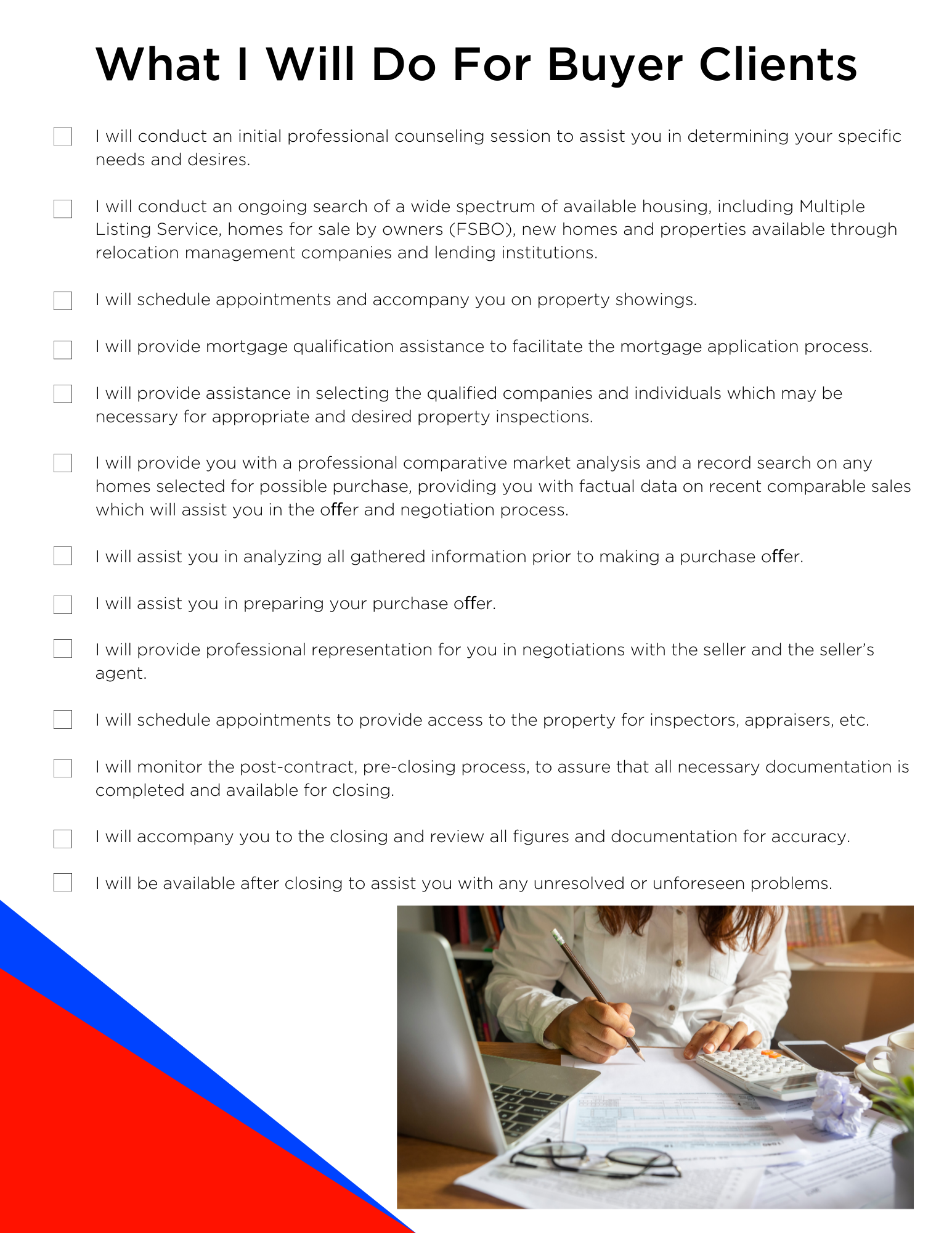

As Your Agent, Jan Will:

- Assure that you see all the properties in the area that meet your criteria

- Guide you through the entire home buying process, from finding homes to look at, to getting the best financing

- Make sure you don’t pay too much for your new home and help you avoid costly mistakes

- Answer all your questions about the local market area, including schools, neighborhoods, the local economy, and more

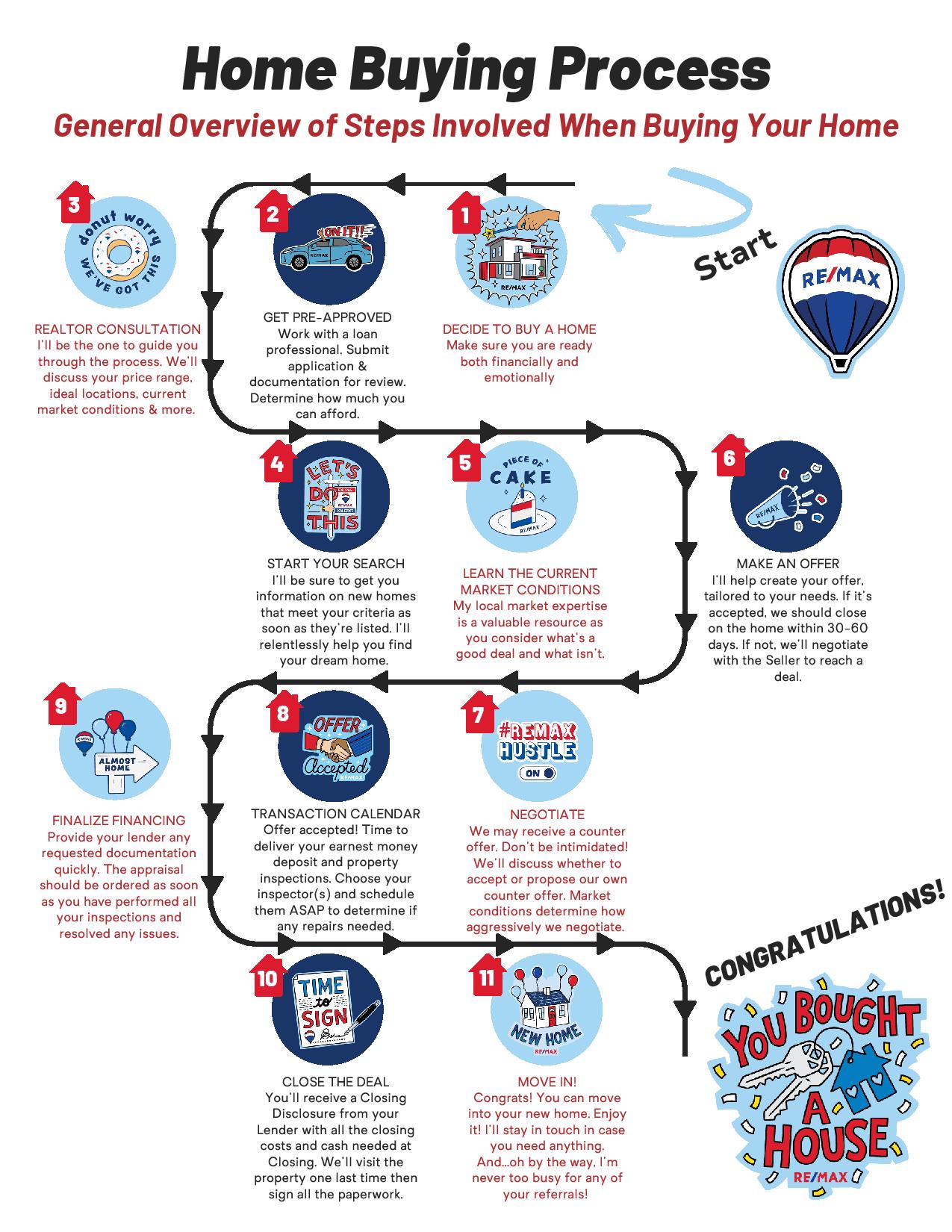

Before You Start Looking for Your New Home:

- Check your credit rating. Straighten out any errors before it’s too late

- Determine a comfortable monthly budget for your new purchase, including down payment and monthly payment

- Find a loan that meets your needs and get pre-qualified (preferably pre-approved)

- Choose a realtor that you trust and who understands your needs

- Determine what neighborhood best matches your needs

- Identify important features you need your new home to have

Take Notice: 2024 Changes

As a new buyer, it's essential to grasp how the recent changes in real estate laws, effective 2024, will impact your purchasing journey. The new regulations have introduced stricter disclosure requirements, meaning sellers must provide more detailed information about property conditions, potentially reducing the risk of unexpected issues post-purchase. Financing has also seen significant adjustments, with revised loan qualification criteria that may affect your borrowing capacity. Additionally, inspection standards have been heightened, ensuring thorough evaluations of properties before closing.

Importantly, there have been changes to real estate commission structures as well. The traditional model where sellers cover the buyer's agent commission is being phased out. Now, buyers are often expected to directly compensate their agents. This shift aims to create more transparency and align the interests of the buyer and agent more closely. As your dedicated realtor, Jan Lazzara, I will navigate these changes with you, ensuring you understand and comply with all new regulations, making your home-buying process as seamless and transparent as possible. Together, we will find the best financial strategies to manage these new commission structures and make your real estate dreams a reality.

To learn more about home buying, call (574) 532-8001.